Revenue Accounting Processes Task

The Revenue Accounting Processes task is a scheduled task that automates the executing, committing, and posting of accounting runs.

The scheduling of accounting processes is applicable to the following accounting runs:

- Non CASS Agent Invoicing

- CASS Agent Invoicing

- Import Invoice at Destination

- Earned Revenue Recognition Process

- Outgoing Interline Accounting Run (for ICH, non-ICH and ACH runs)

- Incoming Interline Invoices

- Outgoing Rejection / Charge Memos (for ICH, non-ICH and ACH runs)

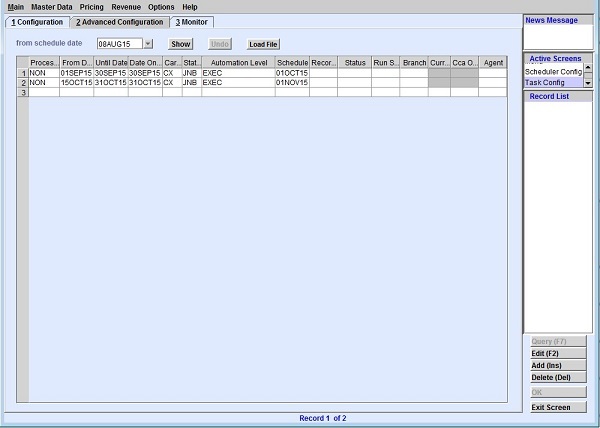

Advanced Configuration

You can define several processes for a specific accounting run in the Advanced Configuration tab. Fields or filters for each process or Process Name may vary depending on your system configuration. Some fields may not be applicable or disabled for certain processes. The Automation Level of a process can be any of the following: EXEC, COMMIT, POST, EXEC COMMIT, COMMIT POST, and EXEC COMMIT POST.Note: You need

the _CRA_ACC_SCHD duty code to be able to edit the settings in the

Advanced Configuration tab.